- About Us

- Our Business

- Investors

- Governance

- Responsibility

- Careers

- News & Event

- Contact Us

Governance

AUDIT COMMITTEE

Audit Committee is an organ of the Board of Commissioners that assists the Board of Commissioners in performing its supervisory duties and function. The scope of supervision of the Audit Committee includes matters related to financial information, internal control systems, effectiveness of audits by External and Internal Auditors, effectiveness of risk management implementation, and compliance with the applicable laws and regulations.

Legal Basis

Indocement’s Audit Committee was established based on:

Audit Committee Work Guidelines

The Company already has an Audit Committee Charter that has been validated by the Company's Board of Commissioners on 6 December 2001, as stated in the Board of Commissioners' Decision Letter No. 012/Kpts/Kom/ITP/XII/2001, and has been adjusted on 6 December 2013, that is through the Statement of Decision Agenda No. 2 of the Board of Commissioners' Meeting No. 007/Kpts/Kom/ITP/XII/2013 on the Amendment to Audit Committee Charter, in order to meet Bapepam-LK No. KEP643/BL/2012 dated 7 December 2012. Furthermore, in performing its duties and responsibilities, the Audit Committee also refers to Financial Services Authority Regulation No. 55/POJK.04/2015 on Establishment and Work Guidelines of Audit Committee. Audit Committee Work Guidelines can be downloaded here.

The Audit Committee Charter, covers the following:

Audit Committee’s Membership

Pursuant to the Committee Audit Charter, concerning Indocement’s Audit Committee membership which consists of:

The Audit Committee is appointed and dismissed by the Board of Commissioners for a period of three years from the appointment, and may be reappointed for one next period. The term of service for the Audit Committee members shall not exceed the term of service of the Board of Commissioners.

The composition of the members of the Indocement Audit Committee as of December 31, 2023 can be seen in the About Us menu >> Management

Audit Committee’s Authority

The committee is empowered to review or oversee matters within its scope of responsibility, to access the Company’s documents, data and information, to directly communicate with any Employee, including the Board of Directors, internal auditor, independent auditor and any relevant parties and to advice from external counsel auditors or other experts as necessary.

Audit Committee Meeting

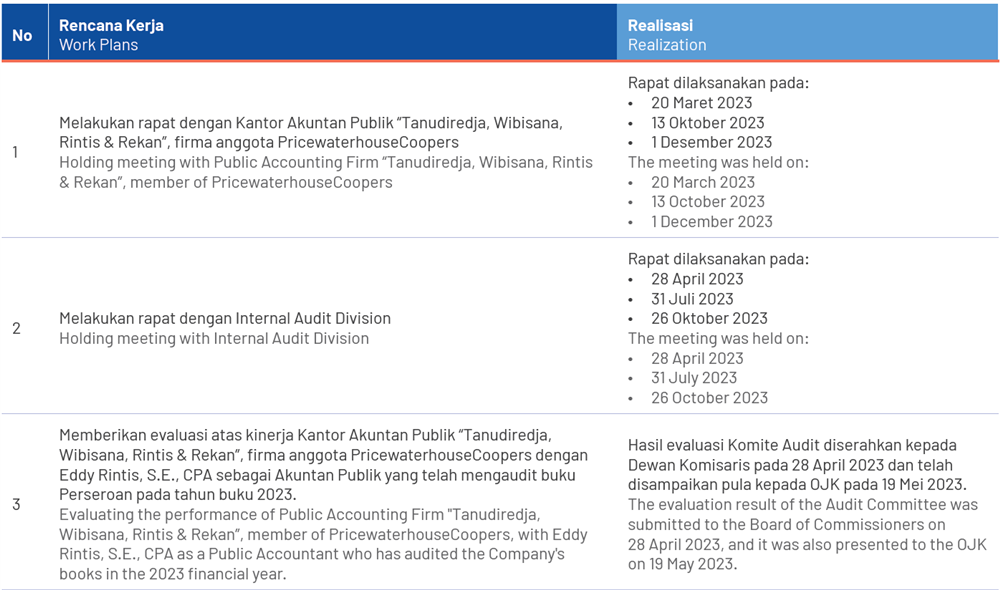

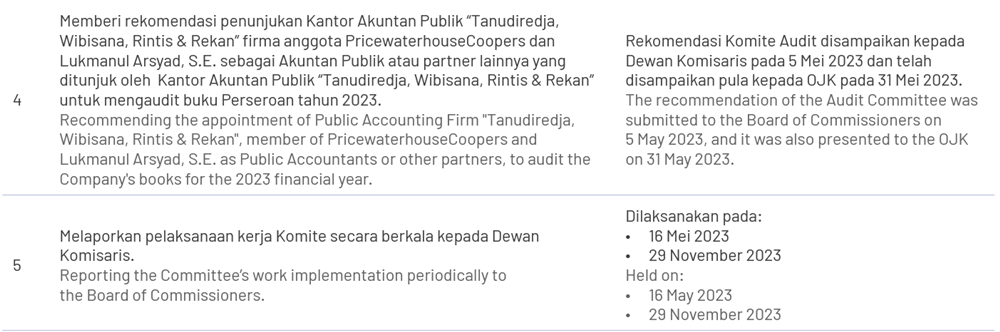

The Implementation of The Audit Committee's Program